Do You Need a Financial Advisor as a Small Business Owner?

A small business may run on a small team, but the number of tasks that you carry out every day can be overwhelming, extensive, and long drawn out. As a small business owner, you wear many hats. Starting from marketing, advertising, hiring, purchasing, sales, and more, every single task requires your attention and judgment. In addition to this, the responsibility to offer your employees and workers a productive and satisfactory environment to work in is also on your shoulders. Having a financial plan for a small business becomes crucial as it allows you to prioritize, strategize, and effectively use your business’s resources.

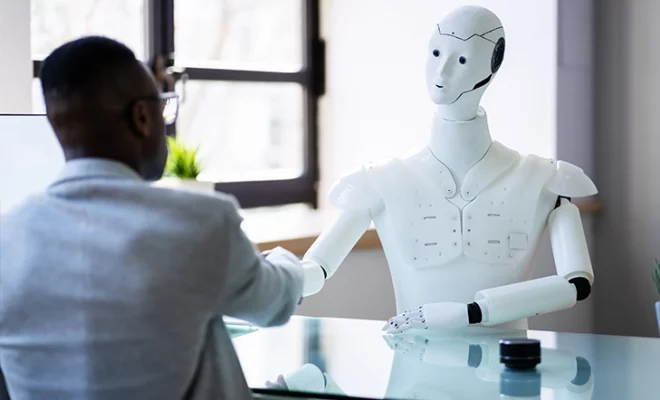

The finances of your business are not limited to profit and loss. Financial planning for business owners also includes setting up retirement accounts for employees, offering them insurance, ensuring that your company’s taxability is reduced, as well as capital allocation, cash flow management, and much more. All of this can require a lot of time, effort, and, most of all, deep understanding and knowledge of tax laws, financial planning, and business planning. While you may or may not have this knowledge or the time to undertake all of this on your own, a financial advisor can help you.

If you are wondering whether or not you need to hire a financial advisor for your small business, here are some benefits that will help you make up your mind and take the leap:

Table of Contents

1. They can help with retirement planning:

Retirement planning for small business owners works on two levels. As a business owner, not only are you responsible for your own financial security, but also that of your business and its employees. As a business owner, you may have to provide retirement planning accounts to your employees. An individual 401(k) retirement account may not be ideal for you. You may not even qualify for one. But you can use a SEP IRA or SIMPLE IRA. A Simplified Employee Pension Individual Retirement Account (SEP-IRA) is a tax-deferred account for self-employed individuals, business owners, and freelancers. Similarly, the Savings Incentive Match Plan for Employees (SIMPLE) IRA is another tax-deferred account for self-employed individuals or small business owners with 100 or fewer employees. A financial advisor for entrepreneurs who run small companies can help you pick a suitable plan according to your needs. They can help you register your employees for these retirement accounts and guide you through the process of contributions. They can also help you earn tax rebates through the contributions that can ultimately benefit your business. The second level of retirement planning includes your own. You may have an active income from your company today, but you would still need a retirement plan for your non-working years. A lot of business owners think they can eventually sell their business in retirement and use the money for their retirement corpus. However, this can be a problematic strategy. Firstly, you cannot predict the performance of your business in the long term. Sometimes, despite the best of efforts, companies fail and crumble under the weight of customer’s expectations, competitors, generational changes, and more. Secondly, you may or may not get a price for your company that would be sufficient to cover your lifetime expenses in retirement. Therefore, you need to plan your retirement and save and invest over the years. The option to sell your business in retirement can be a secondary plan, but it cannot be your primary plan for retirement if you want to live a stress-free and financially secure life.

2. They can offer succession planning advice:

You may want to pass on your business to your future generations someday. You may also have a business partner today and may want to dissolve the partnership tomorrow. All of these decisions can be taken as long as you have a succession plan in place. Succession planning allows you to transfer the ownership of your company to someone else, like a child, grandchild, or any other person. It allows you to bring massive changes in your business’s leadership without disrupting your business, and also ensures that your retirement is secure financially. However, succession planning can be an intricate process as it requires time and great attention to detail. You may have to consider various options, such as transferring the business to your heirs as a part of your estate plan, selling your business to your business partner, to an employee, or to a potential buyer who does not belong to your company. The repercussions of each can be unique and distinct. A small business financial advisor can guide you through them all and help you pick a suitable option that not only aligns to your individual preferences but also benefits your company. Small business advisors can also conduct a business valuation, make a succession plan that ensures a smooth and seamless transfer for both parties, and take care of the legal formalities, so there are no errors and lapses that can cause complications later.

3. They can help you maximize your business’ savings:

Small business advisors can help you maximize your profits and ensure a better cash flow by devising multiple strategies. They can not only recommend different ways to cut costs wherever necessary but also help you invest your profits to gain higher earnings. A small business financial advisor can also study and analyze market trends to help you sell and market your products and services better. They can help you understand that strategy of your competitors and use them to benefit your business. They can be instrumental in creating a business strategy that can involve hiring new employees, using marketing tactics, investing in the stock market, investing in essential equipment, using tax-saving techniques, and more, and help you save and earn more money. In addition to saving and earning money, these professionals can also help you identify areas where you can reduce your expenses. Any wasteful resource or funds can be used for the growth and expansion of your company. The financial acumen of a financial advisor can be one of the greatest assets of your business. And hiring such a professional and delegating essential financial tasks to them can benefit you and your business in several ways.

4. They can help you expand your business:

After a few years of success and growth, the next step for a company is expansion. Expansion can be carried out in a number of ways. You may want to venture into a fresh new sector or you may simply want to introduce a new product or service in the same sector in the market. You may also want to explore other markets, both nationally and internationally. Regardless of how you expand your business, the process is not as easy. There are multiple factors to consider like patents, licenses, permits, etc. Getting these can be a time-consuming process. It can also lead to legal complications sometimes if you commit errors or overlook crucial details. A financial advisor can guide you through the process. These individuals can take care of some of the most vital tasks and simplify the procedure to a great extent. They also reduce the time spent on these tasks.

Similarly, expansion can take years of planning, organizing, and strategizing. It can start with market analysis and research and include bringing in a new partner or accepting investors. All of these things require an expert’s opinion as well as guidance. Small business advisors can help you navigate your way through these complex systems. Moreover, business expansion planning also requires long-term assessments. You must be clear of your long-term goals and how to achieve them. A financial advisor can devise a suitable financial plan for you to expand your business after taking into account all of the factors mentioned above.

5. They can assist you in making timely critical decisions:

Timing is of the essence when running a business. You have to make crucial decisions at the right time to truly take advantage of an opportunity. Timing is also important to evade a mistake and avoid blunders and miscalculations. A financial advisor can help you in many of these critical tasks. For instance, if your sales are low, you may need to hire more people or buy new equipment to produce more products. Both of these options can be expensive and cost your business a lot of money. However, they can also bring in higher profits. Such a scenario requires budgeting and effective planning and timely implementation. This is why it is important to hire a small business financial advisor who can help you manage such time-sensitive tasks without stressing you out and without depleting your business’ resources.

6. They can help you reduce your business’ debt:

Loans, credit card dues, etc., can offer you the funds you require to grow your business but they come at the cost of high interest rates. Paying these back can be problematic as they eat into your profits. It can also be hard to draw a line where debt is concerned. Loans can give you a false sense of liquidity but can ultimately impact your credit score and in some extreme situations even make you lose your assets signed up as collateral. A financial advisor can help you plan your debt in a manner that it benefits you and does not become a burden. They can offer the right financial advice for small business owners that can help you use your business loan effectively, ensure that you have a foolproof repayment plan in place to avoid lapses or misses, and maintain a favorable credit score so you are able to get low-interest business loans in the future. Debt management is crucial in a business and it can greatly impact your profits and help establish goodwill for your brand. A company that defaults in loan payments ends up compromising on its integrity and reliability. This can, in turn, impact your company’s sales and the customer experience. So, to make sure that the company’s name and reputation remain spotless in the market, you may want to consider hiring a small business financial advisor who can help you become debt-free.

How to hire a financial advisor for entrepreneurs

It is important to understand that small business advisors are not necessarily the same as personal financial advisors. While a personal business advisor can help you with your personal finances, retirement planning, estate planning, investments, and savings, a business financial advisor overlooks the financial requirements of your business. To ensure that you hire a competent financial advisor for your small business, you can do the following:

Hire a fiduciary financial advisor:

A fiduciary financial advisor has a legal responsibility to put your business’ interests over their own. This will ensure that the professional acts in favor of your business always and keeps their vested interests away. Fiduciary financial advisors can offer you more peace of mind too.

Discuss the remuneration and compensation method:

You can pay a financial advisor in various forms and methods. Some of these include commissions, monthly fees, hourly fees, etc. The right pick can depend on the scale of your business, your profits, employee strength, and needs. You may start with an hourly fee if you operate on a small scale and do not require round-the-clock assistance. However, as you scale up, you may have to move to a full-time professional who can assist you on all fronts.

Discuss the services you require:

Each business’ needs can differ. You may need a financial advisor for succession planning only. Or you may need their guidance on every aspect of your business. No matter the service you require, discuss it in advance with small financial advisory firms of your choice and hire someone accordingly.

Check their experience and qualifications:

Check the certifications of the financial advisor to gauge their competence. In addition to this, you must also check their experience. Ask them if they have handled the finances of small businesses before or not. This will give you an idea of the kind of work they can tackle and deliver. A small business financial advisor with many years of experience can be a good choice as they would have enough know-how to handle your business. However, it is also important to hire someone who is up to date with the latest laws and business practices and can provide a fresh perspective.

To summarize

It is common to ignore the importance of a financial advisor for a small business as the costs may seem like an avoidable expense. However, small business owners should think of small business advisors as an investment or an asset rather than a liability. A competent financial advisor can help you maximize profits, ensure longevity for your company, reduce your stress, improve employee productivity and ensure their satisfaction, as well as help you streamline multiple other financial aspects of your business. You can benefit from such a professional in several ways and balance your personal and professional life with better clarity and reduced stress.

So, reach out to small financial advisory firms and consider hiring a small business financial advisor for your company to watch it grow over time. Use WiserAdvisor’s free advisor match service to find experienced and certified financial fiduciaries suited to your financial requirements. The free match tool connects you with 1-3 financial advisors that may be able to help you with your financial goals and needs.